Outline

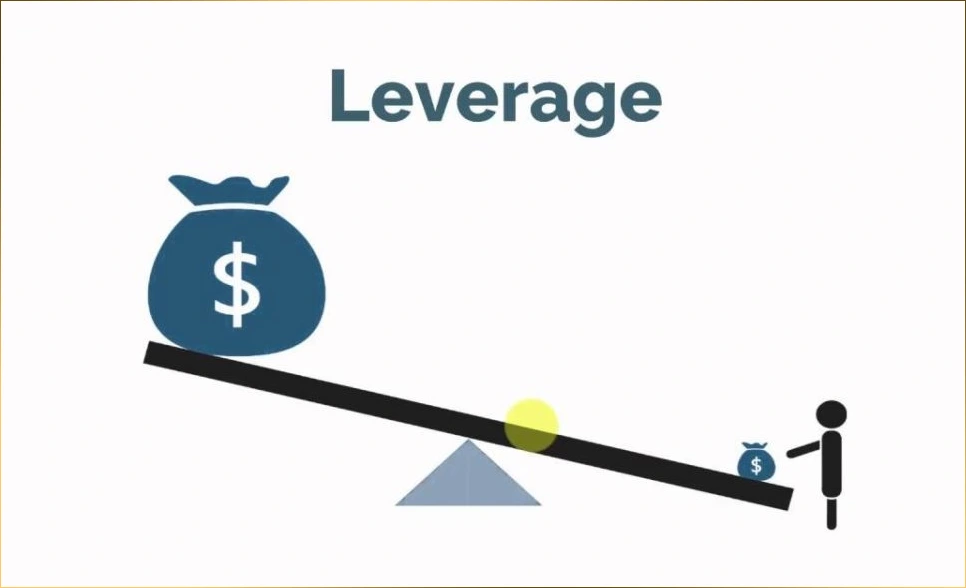

ToggleIn today’s dynamic business landscape, companies often seek opportunities for growth and expansion. One key aspect that facilitates this journey is leveraging financing effectively. Leverage, in the context of a company’s financial operations, refers to the use of borrowed funds or debt to finance its operations and investments with the goal of generating higher returns.

This article explores the concept of leverage, its importance, and how companies can responsibly use it to foster growth while managing potential risks.

Understanding Leverage and Its Significance

Leverage, in financial terms, is the practice of utilizing debt to amplify the potential return on investment. When a company employs leverage, it can access additional funds beyond its existing equity capital to undertake new projects, expand its operations, or make strategic acquisitions. By doing so, the company aims to enhance shareholder value and boost profitability.

The Benefits of Leverage in Business Growth

Leveraging financing offers several advantages for companies seeking growth opportunities:

Access to Additional Capital

One of the primary advantages of leverage is that it enables companies to access additional capital that might not be available through internal funds or equity financing alone. This access to extra funds empowers companies to pursue ambitious projects and enter new markets.

Accelerated Growth

By leveraging debt, companies can accelerate their growth trajectory. They can invest in research and development, launch new product lines, expand their distribution networks, and outpace competitors in the market.

Tax Benefits

Interest payments on debt are typically tax-deductible, which can result in significant tax savings for the company. This reduced tax liability frees up more funds for reinvestment and further contributes to growth.

Responsible Leverage and Risk Management

While leverage can be a powerful tool for growth, it comes with inherent risks that must be prudently managed. Excessive debt can burden a company with high-interest payments and jeopardize its financial stability. Therefore, it is crucial for companies to practice responsible leverage by:

Conducting Thorough Risk Assessments

Before acquiring additional debt, companies should conduct comprehensive risk assessments. They must evaluate the potential returns on investments and assess the company’s ability to service the debt in various economic scenarios.

Maintaining Adequate Cash Flow

Sustainable leverage requires a steady cash flow to cover interest payments and debt obligations. Companies should ensure they have robust cash flow management systems in place to avoid liquidity issues.

Diversifying Sources of Financing

Relying on a single source of financing can expose the company to concentrated risks. Diversifying sources of funding, such as combining debt and equity financing, can reduce the impact of financial downturns.

Real-Life Examples of Leverage in Action

Several successful companies have effectively used leverage to fuel their growth:

Example 1: Tech Giant Expands Globally

A prominent technology company utilized leverage to expand its global presence. By taking on strategic debt, the company built new data centers, hired top talent worldwide, and launched innovative products, solidifying its position as a market leader.

Example 2: Retail Chain’s Aggressive Expansion

A retail chain employed leverage to aggressively expand its store network. The company secured financing to open new stores in untapped markets, rapidly increasing its market share and revenue.

Example 3: Manufacturing Company’s Acquisitions

A manufacturing company used leverage to fund a series of acquisitions. By acquiring smaller competitors and integrating their technologies, the company strengthened its product portfolio and gained a competitive edge in the industry.

Conclusion

Leverage can be a potent instrument for companies looking to operate and grow. When used responsibly, it provides access to additional capital, accelerates growth, and offers tax benefits.

However, companies must exercise caution and conduct thorough risk assessments to ensure that leverage remains sustainable and does not compromise their financial stability.

By striking the right balance between debt and equity financing, companies can leverage their potential for growth and prosperity while navigating the dynamic business landscape effectively.

Compiled by vndicy.com